Property Tax Rates By Illinois County . calculate how much you'll pay in property taxes on your home, given your location and assessed home value. cigarette tax act statistical annual report for new and renewal license and permit applications. the average state property tax rate in illinois is 2.31%, according to data from smartasset. illinois has 102 counties, with median property taxes ranging from a high of $6,285.00 in lake county to a low of. 103 rows this interactive table ranks illinois' counties by median property tax in dollars, percentage of home value, and. use the table below to look up how your county’s property taxes compared to the rest of illinois. Compare your rate to the illinois and u.s. Click on the map below to view rates for a particular county. property tax rates in illinois by county.

from www.illinoispolicy.org

use the table below to look up how your county’s property taxes compared to the rest of illinois. the average state property tax rate in illinois is 2.31%, according to data from smartasset. Click on the map below to view rates for a particular county. Compare your rate to the illinois and u.s. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. illinois has 102 counties, with median property taxes ranging from a high of $6,285.00 in lake county to a low of. cigarette tax act statistical annual report for new and renewal license and permit applications. property tax rates in illinois by county. 103 rows this interactive table ranks illinois' counties by median property tax in dollars, percentage of home value, and.

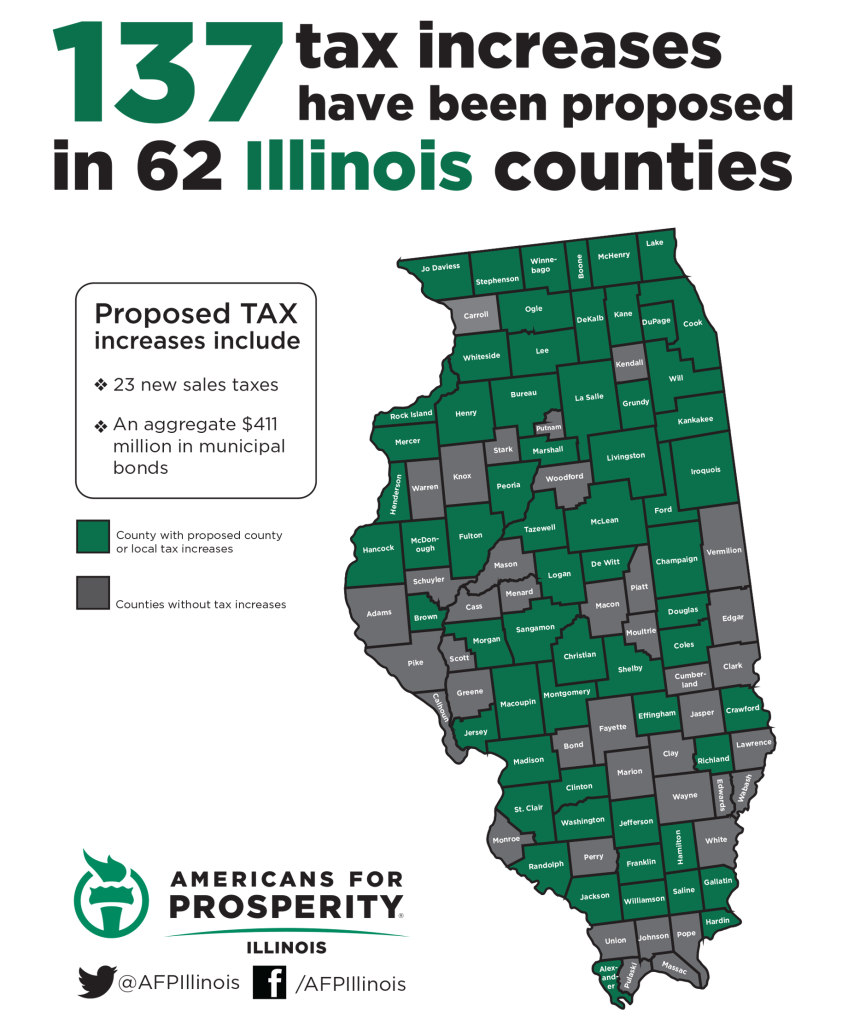

137 tax increases proposed in 62 Illinois counties

Property Tax Rates By Illinois County Compare your rate to the illinois and u.s. use the table below to look up how your county’s property taxes compared to the rest of illinois. the average state property tax rate in illinois is 2.31%, according to data from smartasset. Click on the map below to view rates for a particular county. cigarette tax act statistical annual report for new and renewal license and permit applications. property tax rates in illinois by county. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. 103 rows this interactive table ranks illinois' counties by median property tax in dollars, percentage of home value, and. Compare your rate to the illinois and u.s. illinois has 102 counties, with median property taxes ranging from a high of $6,285.00 in lake county to a low of.

From www.illinoispolicy.org

Chicagoans the mosttaxed residents in Illinois, paying more than 30 Property Tax Rates By Illinois County use the table below to look up how your county’s property taxes compared to the rest of illinois. cigarette tax act statistical annual report for new and renewal license and permit applications. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Click on the map below to view. Property Tax Rates By Illinois County.

From www.illinoispolicy.org

Pensions make Illinois property taxes among nation’s most painful Property Tax Rates By Illinois County 103 rows this interactive table ranks illinois' counties by median property tax in dollars, percentage of home value, and. illinois has 102 counties, with median property taxes ranging from a high of $6,285.00 in lake county to a low of. use the table below to look up how your county’s property taxes compared to the rest of. Property Tax Rates By Illinois County.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rates By Illinois County the average state property tax rate in illinois is 2.31%, according to data from smartasset. Compare your rate to the illinois and u.s. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Click on the map below to view rates for a particular county. property tax rates in. Property Tax Rates By Illinois County.

From www.illinoispolicy.org

Property taxes grow faster than Illinoisans’ ability to pay for them Property Tax Rates By Illinois County 103 rows this interactive table ranks illinois' counties by median property tax in dollars, percentage of home value, and. use the table below to look up how your county’s property taxes compared to the rest of illinois. property tax rates in illinois by county. illinois has 102 counties, with median property taxes ranging from a high. Property Tax Rates By Illinois County.

From www.researchgate.net

effective Property tax rates () in chicago area counties, 2015 Property Tax Rates By Illinois County calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the average state property tax rate in illinois is 2.31%, according to data from smartasset. use the table below to look up how your county’s property taxes compared to the rest of illinois. Click on the map below to. Property Tax Rates By Illinois County.

From www.decaturil.gov

Property Tax City of Decatur, IL Property Tax Rates By Illinois County 103 rows this interactive table ranks illinois' counties by median property tax in dollars, percentage of home value, and. Compare your rate to the illinois and u.s. cigarette tax act statistical annual report for new and renewal license and permit applications. Click on the map below to view rates for a particular county. illinois has 102 counties,. Property Tax Rates By Illinois County.

From www.landhub.com

The Best and Worst Illinois Counties for Property Tax Rates LandHub Property Tax Rates By Illinois County 103 rows this interactive table ranks illinois' counties by median property tax in dollars, percentage of home value, and. the average state property tax rate in illinois is 2.31%, according to data from smartasset. Click on the map below to view rates for a particular county. Compare your rate to the illinois and u.s. illinois has 102. Property Tax Rates By Illinois County.

From www.illinoispolicy.org

Illinois homeowners pay the secondhighest property taxes in the U.S. Property Tax Rates By Illinois County 103 rows this interactive table ranks illinois' counties by median property tax in dollars, percentage of home value, and. Compare your rate to the illinois and u.s. illinois has 102 counties, with median property taxes ranging from a high of $6,285.00 in lake county to a low of. cigarette tax act statistical annual report for new and. Property Tax Rates By Illinois County.

From www.civicfed.org

Estimated Effective Property Tax Rates 20092018 Selected Property Tax Rates By Illinois County cigarette tax act statistical annual report for new and renewal license and permit applications. Click on the map below to view rates for a particular county. 103 rows this interactive table ranks illinois' counties by median property tax in dollars, percentage of home value, and. use the table below to look up how your county’s property taxes. Property Tax Rates By Illinois County.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Property Tax Rates By Illinois County use the table below to look up how your county’s property taxes compared to the rest of illinois. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Click on the map below to view rates for a particular county. 103 rows this interactive table ranks illinois' counties by. Property Tax Rates By Illinois County.

From skydanequity.com

How to Resolve Your Struggle With Illinois Property Taxes SkyDan Property Tax Rates By Illinois County the average state property tax rate in illinois is 2.31%, according to data from smartasset. Compare your rate to the illinois and u.s. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. 103 rows this interactive table ranks illinois' counties by median property tax in dollars, percentage of. Property Tax Rates By Illinois County.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Property Tax Rates By Illinois County 103 rows this interactive table ranks illinois' counties by median property tax in dollars, percentage of home value, and. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Click on the map below to view rates for a particular county. illinois has 102 counties, with median property taxes. Property Tax Rates By Illinois County.

From www.chicagomag.com

Illinois Now Has the SecondHighest Property Taxes in the Nation Property Tax Rates By Illinois County calculate how much you'll pay in property taxes on your home, given your location and assessed home value. use the table below to look up how your county’s property taxes compared to the rest of illinois. Compare your rate to the illinois and u.s. Click on the map below to view rates for a particular county. 103. Property Tax Rates By Illinois County.

From candiebueno.blogspot.com

dupage county sales tax calculator Manual Reynoso Property Tax Rates By Illinois County cigarette tax act statistical annual report for new and renewal license and permit applications. 103 rows this interactive table ranks illinois' counties by median property tax in dollars, percentage of home value, and. use the table below to look up how your county’s property taxes compared to the rest of illinois. property tax rates in illinois. Property Tax Rates By Illinois County.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Property Tax Rates By Illinois County the average state property tax rate in illinois is 2.31%, according to data from smartasset. use the table below to look up how your county’s property taxes compared to the rest of illinois. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. 103 rows this interactive table. Property Tax Rates By Illinois County.

From www.illinoispolicy.org

Illinois property taxes highest in the US, double national average Property Tax Rates By Illinois County the average state property tax rate in illinois is 2.31%, according to data from smartasset. Compare your rate to the illinois and u.s. use the table below to look up how your county’s property taxes compared to the rest of illinois. cigarette tax act statistical annual report for new and renewal license and permit applications. illinois. Property Tax Rates By Illinois County.

From www.illinoispolicy.org

The Chicago squeeze Property taxes, fees and over 30 individual taxes Property Tax Rates By Illinois County Click on the map below to view rates for a particular county. cigarette tax act statistical annual report for new and renewal license and permit applications. 103 rows this interactive table ranks illinois' counties by median property tax in dollars, percentage of home value, and. Compare your rate to the illinois and u.s. illinois has 102 counties,. Property Tax Rates By Illinois County.

From www.civicfed.org

Estimated Effective Property Tax Rates 20082017 Selected Property Tax Rates By Illinois County the average state property tax rate in illinois is 2.31%, according to data from smartasset. Click on the map below to view rates for a particular county. cigarette tax act statistical annual report for new and renewal license and permit applications. use the table below to look up how your county’s property taxes compared to the rest. Property Tax Rates By Illinois County.